4 Documents You Need To Provide Your Attorney To File Bankruptcy

In A Nutshell

(1) Income Information

(a) Employed = Pay Stubs

(b) Self-Employed = Profit And Loss Statement

(2) Tax Returns

(3) Credit Report

(4) Bank Statements

In More Detail

(1) Income Information

(a) Employed = Pay Stubs

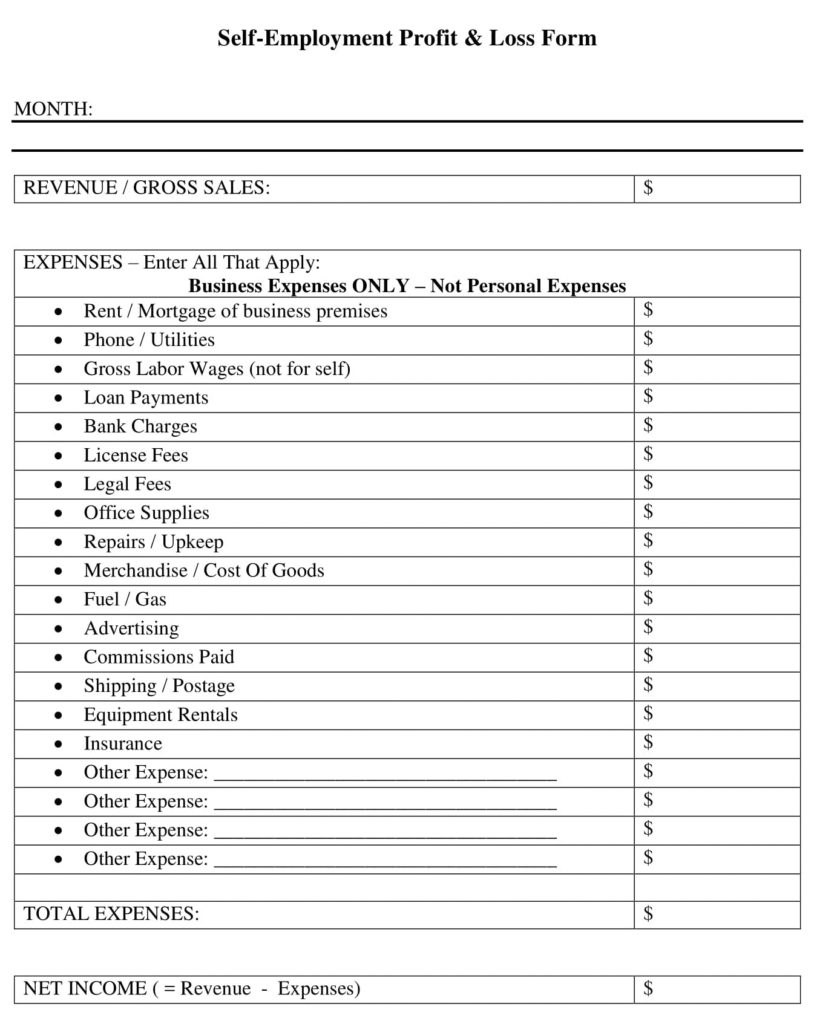

(b) Self-Employed = Profit And Loss Statement

When determining if bankruptcy is right for you and/or which type of bankruptcy (Chapter 7 or Chapter 13) you should file, I as your attorney will need to review your household income. If you are employed, then you likely receive a pay stub showing your gross income, all deductions, and net income. If you are self-employed, then you (or your accountant) will need to create a profit and loss statement showing your revenue, expenses, and profit. Two sample profit and loss statements are below.

Notice that I need to know your household income. You will need to provide me with the income information for everyone living in your home with whom you share expenses. For example, when determining what type of bankruptcy a happily married man should file, the Bankruptcy Code requires me to look at his income as well as his wife’s income even though his wife is not filing a bankruptcy.

The purpose for providing me with your income information is twofold. First, I will need to know your gross income (before any deductions) for the last 6 months to see what you qualify for through what the Bankruptcy Code refers to as the “Means Test.” I will explain the Means Test in a later post. For now, understand that review of your last 6 months of income is the first step in determining what bankruptcy options you have. Second, I will need to look at a snapshot of your budget. Your current income versus your current expenses could give you the option of filing either a Chapter 7 or Chapter 13 or could limit which type is available to you.

Sample Profit & Loss Statement For 6 Month Period

| Month (last 6 months) | Revenue (all income your business has received) | Expenses (all expenses of your business – not personal expenses) | Profit / Loss (Revenue minus expenses) |

| Jan. | $3000 | $1200 | $1800 |

| Feb. | $3200 | $2100 | $1100 |

| March | $2150 | $1600 | $550 |

| April | $2010 | $1500 | $510 |

| May | $1700 | $2000 | ($300) |

| June | $3750 | $2100 | $1650 |

Sample Profit & Loss Statement For Individual Months

(2) Tax Returns

When analyzing your situation, I will need to review your last filed tax return unless it has been several years since the last time you were required to file. Your tax return will provide me with information regarding your income for the previous year as well as other pertinent information. Your last filed tax return will also have to be submitted to the Trustee appointed to your case. Having your last filed tax return in my possession will ensure that it gets sent to the Trustee soon after your case is filed.

Also, if you owe taxes, then it will be helpful for me to review tax returns for those years. Sometimes taxes are discharged through a bankruptcy and sometimes they are not (I will discuss this in a future post). Providing me with tax returns for years you owe taxes will allow me to determine how those taxes will be affected by your bankruptcy.

(3) Credit Report

Possibly the most important information I need when determining what bankruptcy will look like for you is the debts that you owe. You can provide us with a list of your debts or statements you have received from your creditors. But a very good source of your debts is your credit report. You can obtain one free credit report per year from each credit reporting agency. A good website to obtain a free credit report is www.annualcreditreport.com.

(4) Bank Statements

You will likely need to provide me with a copy of your last 2 months of bank statements from your checking account. Your bank statements shed light on information regarding your income and expenses and will allow me, when analyzing your situation, to have a better idea of your household budget. Your statements will also show what expenses/debt payments are being automatically drafted out of your bank account. Depending on the type of bankruptcy you file and depending on the type of expense/debt being drafted, I will be able to advise you to either continue to allow or terminate the draft.