Create A More Manageable Debt Repayment Plan In Chapter 13 Bankruptcy

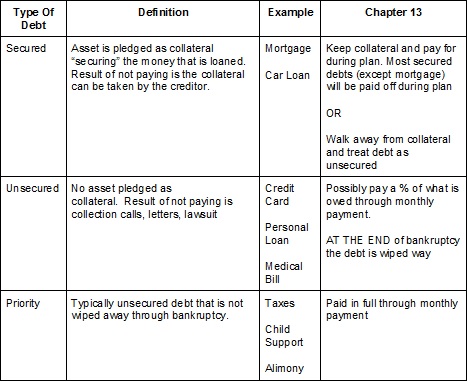

Chapter 13 bankruptcy is often referred to as a “reorganization” of your debt. In a Chapter 13, you enter into a repayment plan where you pay your debts in one monthly payment. This payment will include your payments on your secured debts (i.e. mortgage on house, car loan), any required amount toward unsecured debts (i.e. credit cards, medical bills), and priority debts (i.e. taxes). When in a Chapter 13, you will not make any payments towards any debts in addition to your Chapter 13 payment. Typically your Chapter 13 payment will be less than what you are currently paying monthly to all of your debts.

The question everyone has is: “What will my monthly payment be in a Chapter 13?” Determining the amount of your monthly payment is complicated and will depend on several factors including the type of debt you have (secured vs. unsecured), the status of certain debts (delinquent vs. current), your household income for the last 6 months compared to the median income in your County, your current household budget (income vs. expenses), and the value of the assets you own and what is/is not exemptable.

The question everyone has is: “What will my monthly payment be in a Chapter 13?” Determining the amount of your monthly payment is complicated and will depend on several factors including the type of debt you have (secured vs. unsecured), the status of certain debts (delinquent vs. current), your household income for the last 6 months compared to the median income in your County, your current household budget (income vs. expenses), and the value of the assets you own and what is/is not exemptable.

Secured Debts. Your Chapter 13 payment will include payment on your secured debts. In fact, most of your secured debts (except your house) will be paid in full through your Chapter 13 payment. I will talk about your house and car below, but this portion of your payment will include any other secured debts you have such as financing on furniture, electronics, or appliances.

Keep in mind three things: (1) You do not have to keep your secured debts and pay for them through your Chapter 13 payment. Rather, you have the option to surrender the collateral (i.e. walk away from your house or give the car to the bank) making the debt unsecured. (2) It will take the length of the bankruptcy for the secured item to be paid in full. This can be a good thing in that it stretches the balance owed over a longer period of time, reducing the monthly payment on that debt. But it can be a negative in that it will take longer for you to pay the item off to own it free and clear. (3) You will pay the secured debts off at the Till interest rate. This rate varies from time to time but currently (as of 3/2020) is 6.75%.

Unsecured Debts. Your Chapter 13 payment MAY INCLUDE payment toward a percentage of your unsecured debt or it MAY NOT. This component of your Chapter 13 payment depends entirely on your situation and will be unique to you. You cannot compare your Chapter 13 payment to that of others. Rather your situation must be run through the prism of the Bankruptcy Code to determine if you will pay any amount to your unsecured creditors.

The Law first considers what you can afford. If you can pay all of the required debt (secured and priority) and still have money left over in your budget, then the surplus income will be used to pay toward your unsecured debt.

Next, the Law considers whether you own property/assets with a value falling above the exemption limits. This will cause you to pay towards your unsecured debts an amount equal to the unexempt portion of your assets. For example: your car is worth $20,000 and you owe $10,000. You exempt the equity in your car using the vehicle exemption ($3,500) and the wildcard ($5,000) for a total exemption of $8,500. This leaves $1,500 unexempt, meaning you will have to pay $1,500 toward your unsecured creditors over the life of you Chapter 13 ($1,500 / 60 = $25/month). Any amount still owed to your unsecured creditors at the conclusion of your Chapter 13 will be discharged and wiped away.

Priority Debts. Through your Chapter 13, you will also have to pay back priority debts. Certain debts are defined by the law to be “priority” meaning that they are not discharged through your bankruptcy. The common example of priority debts are TAXES that are recently incurred. The good news is that these debts will be paid in full through the bankruptcy payment.