Declare Chapter 13 Bankruptcy To Help With The Economic Downturn (Coronavirus)

In A Nutshell

1) Create A More Manageable Debt Repayment Plan

2) Stop Foreclosure

3) Prevent Repossession

4) Stop Collection Efforts / Wage Garnishment

5) Discharge Unsecured Debts

In More Detail

1) Create A More Manageable Debt Repayment Plan

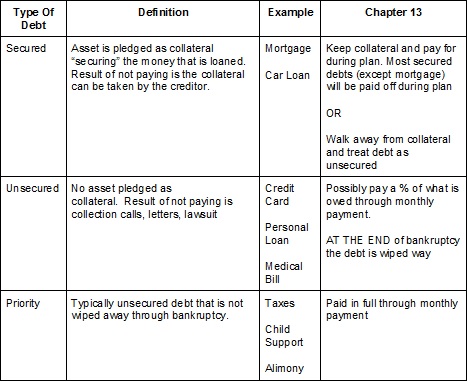

Chapter 13 bankruptcy is often referred to as a “reorganization” of your debt. In a Chapter 13, you enter into a repayment plan where you pay your debts in one monthly payment. This payment will include your payments on your secured debts (i.e. mortgage on house, car loan), any required amount toward unsecured debts (i.e. credit cards, medical bills), and priority debts (i.e. taxes). When in a Chapter 13, you will not make any payments towards any debts in addition to your Chapter 13 payment. Typically your Chapter 13 payment will be less than what you are currently paying monthly to all of your debts.

The question everyone has is: “What will my monthly payment be in a Chapter 13?” Determining the amount of your monthly payment is complicated and will depend on several factors including the type of debt you have (secured vs. unsecured), the status of certain debts (delinquent vs. current), your household income for the last 6 months compared to the median income in your County, your current household budget (income vs. expenses), and the value of the assets you own and what is/is not exemptable.

Secured Debts. Your Chapter 13 payment will include payment on your secured debts. In fact, most of your secured debts (except your house) will be paid in full through your Chapter 13 payment. I will talk about your house and car below, but this portion of your payment will include any other secured debts you have such as financing on furniture, electronics, or appliances.

Keep in mind three things: (1) You do not have to keep your secured debts and pay for them through your Chapter 13 payment. Rather, you have the option to surrender the collateral (i.e. walk away from your house or give the car to the bank) making the debt unsecured. (2) It will take the length of the bankruptcy for the secured item to be paid in full. This can be a good thing in that it stretches the balance owed over a longer period of time, reducing the monthly payment on that debt. But it can be a negative in that it will take longer for you to pay the item off to own it free and clear. (3) You will pay the secured debts off at the Till interest rate. This rate varies from time to time but currently (as of 11/2020) is 5.25%.

Unsecured Debts. Your Chapter 13 payment MAY INCLUDE payment toward a percentage of your unsecured debt or it MAY NOT. This component of your Chapter 13 payment depends entirely on your situation and will be unique to you. You cannot compare your Chapter 13 payment to that of others. Rather your situation must be run through the prism of the Bankruptcy Code to determine if you will pay any amount to your unsecured creditors.

The Law first considers what you can afford. If you can pay all of the required debt (secured and priority) and still have money left over in your budget, then the surplus income will be used to pay toward your unsecured debt.

Next, the Law considers whether you own property/assets with a value falling above the exemption limits. This will cause you to pay towards your unsecured debts an amount equal to the unexempt portion of your assets. For example: your car is worth $20,000 and you owe $10,000. You exempt the equity in your car using the vehicle exemption ($3,500) and the wildcard ($5,000) for a total exemption of $8,500. This leaves $1,500 unexempt, meaning you will have to pay $1,500 toward your unsecured creditors over the life of you Chapter 13 ($1,500 / 60 = $25/month). Any amount still owed to your unsecured creditors at the conclusion of your Chapter 13 will be discharged and wiped away.

Priority Debts. Through your Chapter 13, you will also have to pay back priority debts. Certain debts are defined by the law to be “priority” meaning that they are not discharged through your bankruptcy. The common example of priority debts are TAXES that are recently incurred. The good news is that these debts will be paid in full through the bankruptcy payment.

2) Stop Foreclosure

You may be facing a situation where because of your hardship, you have become unable to keep your mortgage payments current. The mortgage company has decided not to work with  you any further and handed the collection process over to an attorney. The attorney has one method of collecting on a delinquent mortgage…foreclosure.

you any further and handed the collection process over to an attorney. The attorney has one method of collecting on a delinquent mortgage…foreclosure.

Chapter 13 bankruptcy can be filed to stop a foreclosure. Through your Chapter 13 bankruptcy you will pay your normal monthly mortgage payments and the amount you are behind on your mortgage (arrears). At the conclusion of your Chapter 13, you will have made all of your monthly mortgage payments since the inception through the end of your bankruptcy. You will also have paid all of the arrears making your mortgage current. After your Chapter 13, you will commence making your monthly mortgage payments directly to the mortgage company until your mortgage is paid in full.

Timing Of Filing A Chapter 13 To Stop Foreclosure. You must file your Chapter 13 anytime prior to the conclusion of the 10 Day Upset Period (defined below). To say it another way: you must file your Chapter 13 within 10 days following the foreclosure sale date to save your house from being foreclosed.

Now that you know that Chapter 13 will stop the foreclosure, it will be helpful to understand the foreclosure process.

Preforeclosure Notice (45 Day Letter). You will be sent a letter from your mortgage company at least 45 days prior to the filing of the foreclosure proceeding. This letter will detail the amount you are behind, the additional fees required to bring your mortgage current, and other information required by the NC Statutes.

Foreclosure Proceeding. The mortgage company will institute the foreclosure by filing a Special Proceeding in the county in which the land is located (i.e. for land located in Greensboro, NC the Special Proceeding will be filed with the Guilford Courthouse).

Notice Of Default (30 Day Letter). You will be sent another letter from the mortgage company within 30 days of the hearing date. This letter will detail the monies the mortgage company claims it is owed (including principal, interest, and other fees).

Notice Of Hearing. The mortgage company must provide you with notice that a hearing date has been scheduled regarding the foreclosure of your home. This notice must be mailed to you at least 10 days prior to the hearing date OR posted in a conspicuous location at your home at least 20 days prior to the hearing date.

Hearing. At this hearing, the Clerk of Superior Court determines if the mortgage is a valid and enforceable debt and whether or not the mortgage company has met all of the requirements to proceed with the foreclosure sale. The Clerk can continue this hearing up to 60 days from the original hearing date if (1) the property is your residence and (2) there is a reasonable likelihood of the delinquency being resolved without foreclosure.

Notice Of Sale Date. After receiving approval by the Clerk, the mortgage company will send you a notice of the foreclosure sale date. This notice must be sent to you at least 20 days prior to the sale date, posted in a public place (at the courthouse), and advertised in the local newspaper.

Foreclosure Sale. On the scheduled date, the mortgage company will auction the property for sale at the courthouse. Anybody who desires can bid on the property. If no one bids, then the mortgage company itself will purchase the property.

10 Day Upset Period. Following the foreclosure sale, there is a 10 day upset period established where an individual can outbid the previous bidder by making a higher bid on the property (this is similar to a silent auction). Each new bid starts a new 10 day upset period. This process will continue until the bids stop and 10 days pass following the last bid.

3) Prevent Repossession

When you become delinquent on a secured debt (other than a mortgage on real estate), one of the creditor’s methods of collecting upon the debt is to repossess the asset used as collateral for the loan. The most typical situation involving repossession is when an individual falls delinquent on his vehicle. The creditor will hire a towing company to hunt for your car at your residence, place of work, or anywhere else they suspect the car may be located. The creditor does not have to call and give you notice that the tow truck is on its way. Rather, the tow truck  can come spur of the moment and take the vehicle without you knowing. After the repossession, the creditor will sell the vehicle at an auction and apply the proceeds to the debt. The creditor will likely not get the full balance owed from the sale creating a situation where the creditor will attempt to collect the deficiency from you through phone calls, letters, and possibly a lawsuit.

can come spur of the moment and take the vehicle without you knowing. After the repossession, the creditor will sell the vehicle at an auction and apply the proceeds to the debt. The creditor will likely not get the full balance owed from the sale creating a situation where the creditor will attempt to collect the deficiency from you through phone calls, letters, and possibly a lawsuit.

One question I often get asked is, “How delinquent do I have to be on my car before the creditor will repossess it?” The answer is that it depends on the creditor and the situation. You only have to be 1 payment behind for the vehicle to be repossessed. Although I have found that the magic number is typically 2 to 3 months behind before the creditor will repossess. Some creditors move faster than others. Also, if you have a history of falling delinquent on the vehicle payments, then the creditor may hold a shorter leash and move to repossess sooner.

Chapter 13 will prevent your vehicle from being repossessed. As soon as you file a Chapter 13 you get the benefit of the “Automatic Stay” which is a mechanism created by the Law that immediately stops all collection efforts. This includes repossession of your vehicle. In fact if your vehicle has been repossessed and you file a Chapter 13 prior to the creditor selling the vehicle (the sale usually occurs 10 days or more after the repossession), then through a Chapter 13 you will likely be able to get your vehicle back as long as it is properly insured.

In most Chapter 13s you will pay off the vehicle loan and receive the title at the conclusion of the bankruptcy. The amount you pay for the vehicle will depend on the length of time you have owned the vehicle, the balance owed, and the car’s value. If you purchased your vehicle less than 910 days prior to the filing of your bankruptcy, then you must pay the full balance owed on your car. If you purchased your vehicle more than 910 prior to the filing of your bankruptcy, then you can pay back the lesser of the value of the vehicle or the balance owed.

SIDE NOTE: Chapter 13 will also discharge any old repossession you have on your credit where the vehicle has been sold and a delinquency is owed. This type of debt will be viewed as “unsecured” and will be treated accordingly. But the bottom line is: any amount remaining owed at the end of your Chapter 13 will be wiped away.

4) Stop Collection Efforts / Wage Garnishment

As mentioned above, as soon as your Chapter 13 is filed you will receive the benefit of the “Automatic Stay” which requires all collection efforts to immediately cease. All phone calls, collection letters, lawsuits, and all other forms of collection must stop.

One of the more consequential methods of debt collecting is wage garnishment. Wage garnishment is where your employer is required to withhold from your wages a certain amount each paycheck and send the money to your creditor. The garnishment will continue until the entire debt is paid in full. Your employer cannot garnish 100% of your wages. In fact, the amount that can be garnished will depend on the type of debt.

North Carolina law has limited the types of debt that can be garnished from your wages. The only debts that can be garnished in NC are: taxes, alimony, child support, student loans, ambulance bills from some counties, and judgments obtained in other states that allow wage garnishment. NC law does not allow a creditor for debt resulting from a credit card, personal loan, mortgage, etc. to collect upon the debt via wage garnishment. Even if the creditor gets a judgment in NC, they cannot garnish your wages. BUT the creditor may be allowed to garnish if it obtains a judgment against you in another state that allows wage garnishment pursuant to judgment liens.

If your wages are being garnished pursuant to a debt, then Chapter 13 can be used to stop the garnishment. Chapter 13 will stop garnishment for taxes and judgment liens. Your taxes (if priority) will be paid for through your Chapter 13 payment, not through wage garnishment. If the taxes are nonpriority, then they will be paid the same percentage as your other unsecured debts. The judgment lien will be treated as an unsecured debt as well. Other steps will be taken to deal with this lien through your bankruptcy if necessary.

Certain wage garnishment may not cease because of a Chapter 13. Alimony and child support are nondischargeable debts in bankruptcy. The garnishment for these will not stop upon the bankruptcy being filed. Student loans are also nondischargeable in most bankruptcy cases. But the garnishment for these will stop during your Chapter 13 and possibly resume once the bankruptcy ends.

5) Discharge Unsecured Debts

The main reason a majority of people file a Chapter 13 is to receive a discharge of their unsecured debts. The discharge is the “light at the end of the tunnel.” It is received at the END of your bankruptcy. You do not receive your discharge upon the filing of a Chapter 13. Rather you have to make all of your payments (for 36 to 60 months) before the Court signs an order discharging your debts.

Practically speaking, a discharge is 2 things. First, the discharge wipes away your debts. After the conclusion of your bankruptcy, you will not owe any amount to any creditor for any debt incurred PRIOR TO your bankruptcy being filed. The discharge does not wipe away debts incurred during or after your bankruptcy. Second, the discharge is an injunction against creditors attempting to collect a discharged debt from you. The automatic stay commencing when your bankruptcy is filed turns into the “discharge injunction” which forever bars collection attempts by your creditors.