4 Things That Must Be Done After Filing Chapter 13 Bankruptcy

When filing a Chapter 13 bankruptcy you must consider the due dates for several events occurring within the first month of your case.

Read MoreWhat To Do When The Foreclosure Moratorium Ends

With the foreclosure moratorium set to expire on June 30, 2021 you may need to consider your options to prevent foreclosure of your home. Chapter 13 bankruptcy is an option that will allow you to keep your home and catch up the amount you are behind on your mortgage.

Read MoreHow Can Bankruptcy Help With Evictions in North Carolina?

Use bankruptcy to stop eviction and remain in your home or to get out of your lease and wipe away past-due rent.

Read MoreHow Often Can I File Bankruptcy?

Due to unforeseen, unexpected circumstances that arise in the lives of people within a household, individuals or spouses are sometimes forced to consider filing for bankruptcy again.

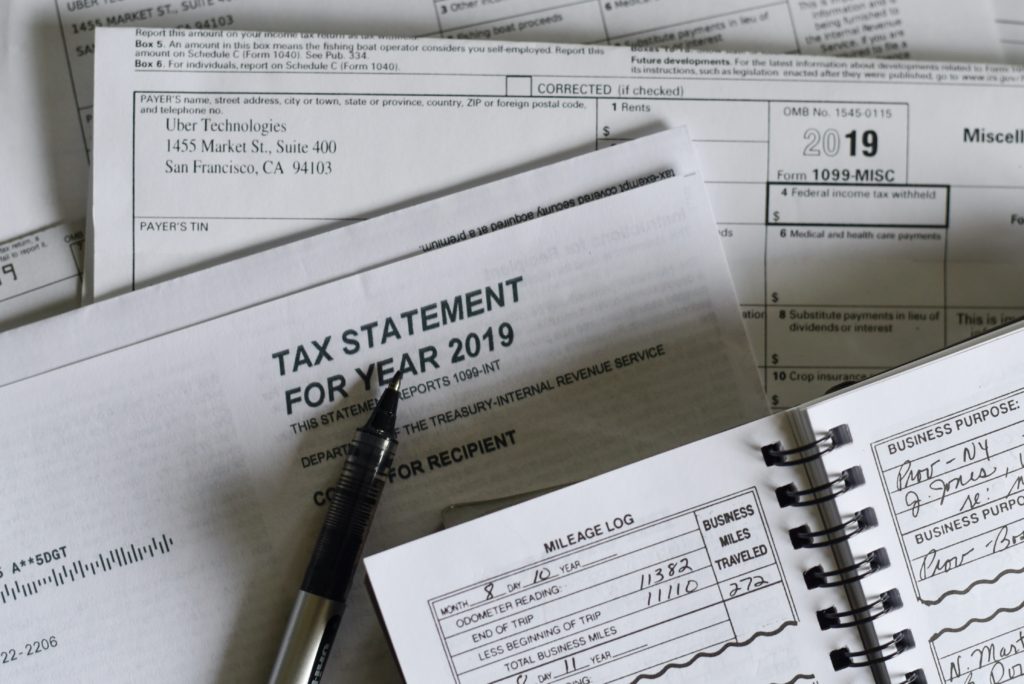

Read MoreWhat Happens to Your Tax Refund in Bankruptcy

It is important to speak with a bankruptcy attorney about your tax refund if you are considering bankruptcy.

Read MoreStudent Loans In Bankruptcy – 3 Things To Know

Student Loans In Bankruptcy – 3 Things To Know

1) Student Loans Are Non-Dischargeable In Most Cases

2) Student Loans Are Dischargeable In Limited Circumstances (Brunner Test)

3) Possible Changes Coming?

Declare Chapter 13 Bankruptcy To Help With The Economic Downturn (Coronavirus)

Declare Chapter 13 Bankruptcy To Help With The Economic Downturn (Coronavirus)

1) Create A More Manageable Debt Repayment Plan

2) Stop Foreclosure

3) Prevent Repossession

4) Stop Collection Efforts / Wage Garnishment

5) Discharge Unsecured Debts

We Can Help Overcome The Fear Of Bankruptcy

Do not fear. Bankruptcy is such a useful tool that is not taken advantage of by most people who need help. Let us help you.

Read MoreChapter 13 Bankruptcy Payments – How To Calculate Yours

Every person I meet with regarding a Chapter 13 bankruptcy wants to know what their monthly Chapter 13 payment will be…obviously.

Read MoreTaxes In Bankruptcy – When can tax debt be discharged in bankruptcy?

Taxes In Bankruptcy – When can tax debt be discharged in bankruptcy?

1) Priority Status Of Taxes

2) Income Taxes

3) Payroll Taxes

4) Property Taxes