5 Factors To Determine If You Should File Chapter 7 Or Chapter 13 Bankruptcy

Click Here For Your Free Bankruptcy Evaluation

In A Nutshell

(1) Type Of Debt

(2) Status (Current vs. Delinquent) Of Secured Debt

(3) Income

(4) Value Of Your Property

(5) Your Choice (Sometimes)

In More Detail

(1) Type Of Debt

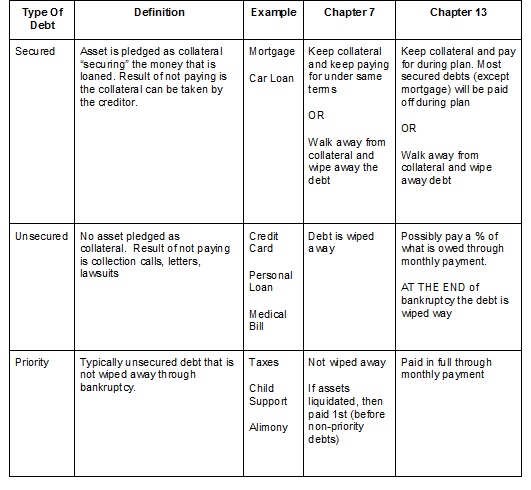

Debts are broken down into different categories that are important when determining which type of bankruptcy you can file. Just having one type of debt versus another and not being delinquent does not definitively mean that you will file one type of bankruptcy over the other. Rather it means that there may be more benefits to filing one type over the other. The types of debts are secured, unsecured, and priority.

Definition Of Secured Debts. Secured debts are those which the borrower (you) pledges an asset you own as collateral for the money that is loaned. The most common secured debts are a mortgage (secured by land) and vehicle loan (obviously secured by a vehicle). The result of not paying a secured debt is that the asset used as collateral is taken back by the creditor. This is often seen through foreclosures of people’s homes or repossessions of their vehicles.

Secured Debts In Bankruptcy. Secured debts are treated differently depending on the type of bankruptcy you file. In a Chapter 7, you get to decide (in most circumstances) whether or not you keep the item used as collateral for the secured debt. If you keep the asset, then nothing changes with the terms of the debt. If you do not keep the asset, then you no longer have any interest in the asset but also no longer are liable for the secured debt. In a Chapter 13, you also get to decide (in most circumstances) whether or not you keep the item used as collateral. If you keep the asset, then the secured debt will be paid through your monthly bankruptcy payment (I will discuss more regarding this payment in a later post). If you do not keep the asset, then, like a Chapter 7, you walk away from the asset but are no longer liable for the debt.

Definition Of Unsecured Debts. Unsecured debts are those where there is no collateral acting as security for the debt. The borrower (you) simply agree to pay back the debt owed. The typical unsecured debts that individuals incur are credit cards, personal loans, and medical bills. The result of not paying an unsecured debt is that action is taken against you to “encourage” you to pay. These collection efforts often take the form of collection calls, collection letters, and lawsuits.

Unsecured Debts In Bankruptcy. Chapter 7 and Chapter 13 Bankruptcies vary in how they treat unsecured debt. In a Chapter 7, you will wipe away all of your unsecured debt. You will never pay anymore on unsecured debts, and the creditors have to cease all collection efforts until the end of time. In a Chapter 13, your unsecured debts may (or may not) be paid a percentage of what they are owed. In a lot of Chapter 13s the unsecured creditors receive 0% of what they are owed. Determining what percentage of unsecured debt has to be paid requires a complicated analysis of your entire situation (fill out our online intake form for a free evaluation). AT THE END of your bankruptcy, all of your outstanding unsecured debt will be wiped away.

Definition Of Priority Debt. Certain debts are given priority status in bankruptcy. These debts are typically unsecured debts but do not receive the same treatment in bankruptcy as discussed above. The typical priority debts are certain taxes owed to the government, child support, and alimony.

Priority Debts In Bankruptcy. In a Chapter 7, priority debts are not wiped away. Rather, these debts will survive the bankruptcy and still have to be paid. If your property has to be liquidated in your Chapter 7, then priority debts will be paid before non-priority unsecured debts. In a Chapter 13, these debts will typically be paid in full through your monthly plan payment. Taxes, child support arrearage, and alimony arrearage are 3 examples of priority debt that will be paid in full through your monthly plan payment. If you are not behind on child support and alimony, then these ongoing obligations can continue to be paid by you to the recipient outside of the bankruptcy payment.

(2) Status (Current vs. Delinquent) Of Secured Debt

You may have to file one type of bankruptcy over the other due to the status of your secured debt. If you are current on your secured debt, then you will have the option of filing either a Chapter 7 or Chapter 13 if you qualify based on the rest of your situation. For example, you are not behind on your car payment and your income and value of assets allows you to qualify for a Chapter 7, then you will have the option to file either a Chapter 7 or Chapter 13.

If you are behind on your secured debt, then you may need to file a Chapter 13 to ensure the collateral for the secured debt does not get taken from you. For example, if you have not made a car payment for 2 months, then you can file a Chapter 13 to keep the car from being repossessed. As soon as the bankruptcy is filed the creditor is prevented from taking your car. As explained above, the debt owed on the car will be paid for through the monthly Chapter 13 payment.

(3) Income

The amount of income your household makes could control the type of bankruptcy you are able to file. Notice that I wrote “household income.” The law considers the income of those living with you and with whom you share expenses when determining what type of bankruptcy you can file. For instance, if you are married and living with your wife but want to file a bankruptcy by yourself, then the law considers your income AND the income of your spouse.

The size of your household (you, your spouse, and your 2 children) is the next factor considered in this analysis. Your income is compared to the median income of a household of the same size to determine if you can file either a Chapter 7 or Chapter 13 or if your options are limited to only a Chapter 13.

I describe this process as the law drawing a line in the sand with the line representing the median income of a household the size of your household. If the sum of your household income falls short of the line, then your bankruptcy options are open to file either a Chapter 7 or Chapter 13. If the sum of your household income falls beyond the line, then we move into the next step of examining your expenses. Certain expenses you have are used as deductions from your household income to possibly bring your income short of the line in the sand. If this occurs, then again you can file either a Chapter 7 or Chapter 13. If your expenses are not great enough and you stay beyond the line in the sand, then your only bankruptcy option will be a Chapter 13.

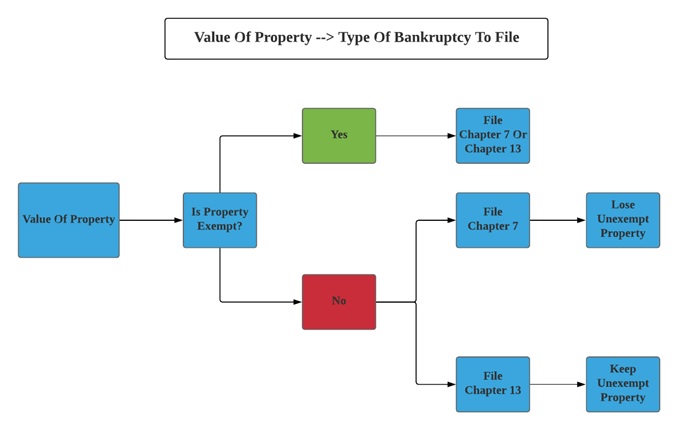

(4) Value Of Your Property

When you file a bankruptcy you have to list all of the property you own and its value in your bankruptcy petition. You have to list EVERY asset in which you have an interest. If an asset you own is not listed, then serious consequences can result.

Valuing your assets can sometimes be a chore, but you need to spend adequate time researching the values because of its importance. There will be a Trustee appointed in your bankruptcy case, and they will certainly take the time to research the value of your assets. If you have incorrectly listed the value of an asset and the value is much higher, then it could cause you to lose the asset in a Chapter 7 or cause an increase in your plan payment in a Chapter 13.

After valuing your assets, you will then need to see which assets are exempt. The law has created certain Exemptions for certain property that you own. Basically, you are allowed to own a certain value of things. These “things” are broken down into different exemptable categories such as your residence, car, household goods, and more. If the asset you want to exempt does not fall into one of the preset categories, then the law gives an amount called a “wildcard” that can be used to exempt a limited amount of property you own.

So how does all of this affect which type of bankruptcy you can file?

If all of your property is exempt, then you can file either a Chapter 7 or a Chapter 13 and keep all of your property.

If some of your property is not exempt, then Chapter 7 may force you to either lose the item or have to pay money into your case and Chapter 13 will force a higher monthly bankruptcy payment but allow you to keep the property.

In a Chapter 7, the bankruptcy trustee appointed to your case will want to sell the unexempt property and use the proceeds to pay off some of your unsecured debt (i.e. credit cards, personal loans, medical bills). You would be forced to either give him the unexempt item or settle for a lesser amount by paying cash. Either way, you are having to give the trustee more than you desire. Keep in mind that if the value of the unexempt property is more than you can afford to settle with the trustee then you will lose the property.

For example, an individual in a Chapter 7 has a vehicle worth $10,000.00 that has no debt on it. The individual has no other property to their name. The individual can use his vehicle exemption to exempt $3,500.00 of the vehicle and his wildcard to exempt $5,000.00 of the vehicle for a total exemption of $8,500.00. This leaves $1,500.00 of the vehicle unexempt. The Trustee will want to take and sell the vehicle. Or the individual can attempt to settle with the Trustee by paying (for instance) $1,000.00.

In a Chapter 13, the trustee will not take your unexempt items and sell them. Rather you will pay through your bankruptcy payment an amount equal to the unexempt property. The extra amount in your bankruptcy payment will be used to pay a percentage of your unsecured debt.

Using the example from above but here the individual filed a Chapter 13. The individual will not lose his vehicle. Instead he will pay an extra $1,500.00 through his bankruptcy payment over the life of the bankruptcy. If his bankruptcy lasts 60 months, then he will pay $25.00 ($1,500 / 60 = $25) toward his unsecured creditors.

Obviously, the value of your property and the amount you are able to exempt is crucial to your bankruptcy case. Fill out our online intake form to allow us to assist you in determining what options you have.

(5) Your Choice (Sometimes)

If you are current on your secured debt, you do not make “too much” income, and you are able to exempt all of your property, then will be able to file either a Chapter 7 or a Chapter 13. While considering the pros and cons of either type of bankruptcy, the decision on which one to file will be yours. Often it makes since to file a Chapter 7, wipe away your unsecured debt, and continue to pay your secured debt until paid off. On the other hand, a Chapter 13 will be beneficial if you can reduce your total monthly expenses by giving you a debt payment that is much lower than what you are paying now. Relying on an attorney’s advice and counseling can assist you in making this decision.